De Documentations Patas-monkey

Aller à la navigation

Aller à la recherche

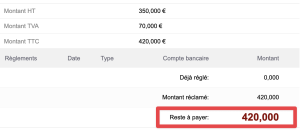

| Taking into account the ExtraExpense line

| Calculation of the VAT Amount

|

| 20 |

+ |

20 |

+ |

30 |

= |

70

|

|

Based on the expense reports created previously, we obtain the following:

- 20% VAT on a pre-tax amount of €100, resulting in a total including tax of €120 and a VAT of €20

- 10% VAT on a pre-tax amount of €200, resulting in a total including tax of €220 and a VAT of €20

- 0% VAT on a pre-tax amount of €50 and a total including tax of €80, resulting in a VAT of €80 - €50 = €30

|