« Extraexpense/en » : différence entre les versions

Page créée avec « == Usage and Features == » |

Page créée avec « With the '''ExtraExpense''' module, when the '''VAT rate = 0%''', you can still enter a price in '''Excluding VAT''' and in '''Including VAT''', without one of the two fields being blocked when the other is filled in. » |

||

| Ligne 70 : | Ligne 70 : | ||

|} | |} | ||

< | <span id="Fonctionnalité_avec_ExtraExpense"></span> | ||

=== | === ExtraExpense Features === | ||

With the '''ExtraExpense''' module, when the '''VAT rate = 0%''', you can still enter a price in '''Excluding VAT''' and in '''Including VAT''', without one of the two fields being blocked when the other is filled in. | |||

<div lang="fr" dir="ltr" class="mw-content-ltr"> | <div lang="fr" dir="ltr" class="mw-content-ltr"> | ||

Version du 5 novembre 2025 à 14:56

Configuration

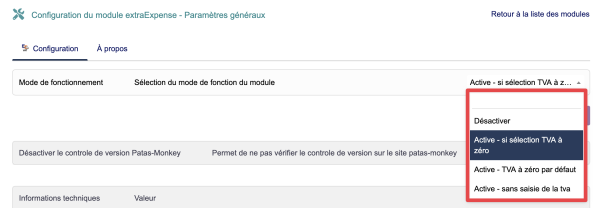

In the module settings you will have the option to choose several operating modes:

| Basic Function |

|

Usage and Features

When creating or editing an expense report (via the expense report management form), the VAT rate management is automatically handled to avoid any calculation errors.

Basic Functioning

VAT Rate Management: When you change the VAT rate of a line, an internal mechanism disables keyboard events on the price fields to prevent the simultaneous entry of the Excluding VAT and Including VAT values.

This ensures the consistency of calculations and avoids input errors.

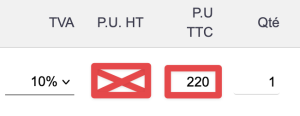

Concrete example: If you change the VAT rate of a line (for example from 0% to 20% or other), the Price excl. VAT and Price incl. VAT fields will be automatically linked.

One of the two fields will be disabled to prevent double entry.

| Basic function |

The Price including tax field will be automatically calculated when the line is validated. |

| Basic function |

The Excluding VAT field will be automatically calculated when the line is validated. |

ExtraExpense Features

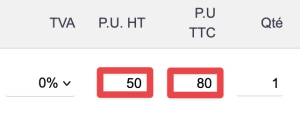

With the ExtraExpense module, when the VAT rate = 0%, you can still enter a price in Excluding VAT and in Including VAT, without one of the two fields being blocked when the other is filled in.

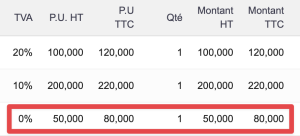

Exemple :

| Fonction avec ExtraExpense |

Si TVA = 0 % et que le Prix HT = 50 €, vous pouvez également saisir la case TTC avec un autre montant. Le montant de la TVA est déterminé à partir de la différence des deux montants (ici 30€ soit un taux de 60% de TVA) |

Validité de la ligne

Prise en compte de la ligne ExtraExpense

|

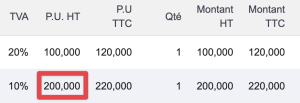

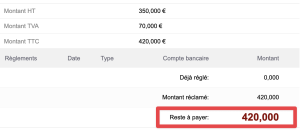

En suivant les notes de frais créées précédemment, nous obtenons les éléments suivants :

Nous avons alors un montant de TVA de : 20 + 20 + 30 = 70€ comme affiché sur le total.

| ||||||||||||||