« Extraexpense/en » : différence entre les versions

Page créée avec « We then have a VAT amount of: 20 + 20 + 30 = €70 as shown on the total. » |

Mise à jour pour être en accord avec la nouvelle version de la source de la page |

||

| (8 versions intermédiaires par un autre utilisateur non affichées) | |||

| Ligne 16 : | Ligne 16 : | ||

In the module settings you will have the option to choose several operating modes: | In the module settings you will have the option to choose several operating modes: | ||

<div class="mw-translate-fuzzy"> | |||

{| class="wikitable" | {| class="wikitable" | ||

|- style="vertical-align:top" | |- style="vertical-align:top" | ||

| width="300px" | Basic Function | | width="300px" | Basic Function | ||

[[File: | [[File:ExtraExpense_parametrage_en.png |600px]] | ||

| | | | ||

* Disable: The module is not active; VAT management for expense reports works by default. | * Disable: The module is not active; VAT management for expense reports works by default. | ||

| Ligne 25 : | Ligne 26 : | ||

* Enabled - VAT is set to zero by default: Same as above, but the VAT rate is pre-selected. | * Enabled - VAT is set to zero by default: Same as above, but the VAT rate is pre-selected. | ||

* Enabled - without VAT entry: The VAT selection is removed, and entry of both total (including tax) and pre-tax amounts is mandatory. | * Enabled - without VAT entry: The VAT selection is removed, and entry of both total (including tax) and pre-tax amounts is mandatory. | ||

</div> | |||

|} | |} | ||

| Ligne 47 : | Ligne 49 : | ||

|- style="vertical-align:top" | |- style="vertical-align:top" | ||

| width="300px" | Basic function | | width="300px" | Basic function | ||

[[File: | [[File:ExtraExpense_fonction_sans_extraexpense_001_en.png |300px]] | ||

[[File: | [[File:ExtraExpense_fonction_sans_extraexpense_result_001_en.png |300px]] | ||

| | | | ||

* If '''VAT = 20%''' and the '''Price excluding tax = €100''', you will not be able to fill in the '''Price including tax''' field. | * If '''VAT = 20%''' and the '''Price excluding tax = €100''', you will not be able to fill in the '''Price including tax''' field. | ||

| Ligne 60 : | Ligne 62 : | ||

|- style="vertical-align:top" | |- style="vertical-align:top" | ||

| width="300px" | Basic function | | width="300px" | Basic function | ||

[[File: | [[File:ExtraExpense_fonction_sans_extraexpense_002_en.png |300px]] | ||

[[File: | [[File:ExtraExpense_fonction_sans_extraexpense_result_002_en.png |300px]] | ||

| | | | ||

* If '''VAT = 10%''' and the '''Price including VAT = €220''', you will not be able to fill in the '''Excluding VAT''' field. | * If '''VAT = 10%''' and the '''Price including VAT = €220''', you will not be able to fill in the '''Excluding VAT''' field. | ||

| Ligne 80 : | Ligne 82 : | ||

|- style="vertical-align:top" | |- style="vertical-align:top" | ||

| width="300px" | Function with ExtraExpense | | width="300px" | Function with ExtraExpense | ||

[[File: | [[File:ExtraExpense_function_AVEC_extraexpense_en.png |300px]] | ||

[[File: | [[File:ExtraExpense_fonction_avec_extraexpense_result_en.png |300px]] | ||

| | | | ||

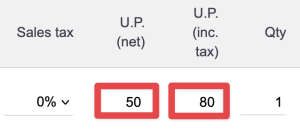

If '''VAT = 0%''' and the '''Price excluding tax = €50''', you can also enter a different amount in the '''Including tax''' field. | If '''VAT = 0%''' and the '''Price excluding tax = €50''', you can also enter a different amount in the '''Including tax''' field. | ||

| Ligne 95 : | Ligne 97 : | ||

|- style="vertical-align:top" | |- style="vertical-align:top" | ||

| width="300px" | Taking into account the ExtraExpense line | | width="300px" | Taking into account the ExtraExpense line | ||

[[File: | [[File:ExtraExpense_validite_ligne_en.png |300px]] | ||

{| class="wikitable" style="width:100%; margin:auto; text-align:center; font-size:130%;" | {| class="wikitable" style="width:100%; margin:auto; text-align:center; font-size:130%;" | ||

|- | |- | ||

Dernière version du 12 novembre 2025 à 15:08

Configuration

In the module settings you will have the option to choose several operating modes:

| Basic Function |

|

Usage and Features

When creating or editing an expense report (via the expense report management form), the VAT rate management is automatically handled to avoid any calculation errors.

Basic Functioning

VAT Rate Management: When you change the VAT rate of a line, an internal mechanism disables keyboard events on the price fields to prevent the simultaneous entry of the Excluding VAT and Including VAT values.

This ensures the consistency of calculations and avoids input errors.

Concrete example: If you change the VAT rate of a line (for example from 0% to 20% or other), the Price excl. VAT and Price incl. VAT fields will be automatically linked.

One of the two fields will be disabled to prevent double entry.

| Basic function |

The Price including tax field will be automatically calculated when the line is validated. |

| Basic function |

The Excluding VAT field will be automatically calculated when the line is validated. |

ExtraExpense Features

With the ExtraExpense module, when the VAT rate = 0%, you can still enter a price in Excluding VAT and in Including VAT, without one of the two fields being blocked when the other is filled in.

Example :

| Function with ExtraExpense |

If VAT = 0% and the Price excluding tax = €50, you can also enter a different amount in the Including tax field. The VAT amount is determined by the difference between the two amounts (here €30, which corresponds to a VAT rate of 60%). |

Line validity

Taking into account the ExtraExpense line

|

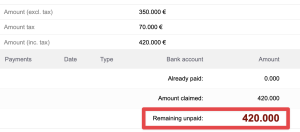

Based on the expense reports created previously, we obtain the following:

We then have a VAT amount of: 20 + 20 + 30 = €70 as shown on the total.

| ||||||||||||||